Powering Risk Protection for Battery Manufacturers

Battery manufacturing is the heartbeat of California’s renewable energy and electric vehicle industries. Whether you’re producing lithium-ion, lead-acid, or solid-state batteries, your operations carry complex risks—from chemical exposure to fire hazards, equipment failure, and global supply chain interruptions.

Battery Manufacturing Insurance is designed to help you navigate these risks and keep your operations running smoothly. With policies built for your industry, you can focus on innovation while we handle the unexpected.

Why Battery Manufacturers in California Need Insurance

Battery production—especially lithium-ion—carries high regulatory and operational risk. Insurance is not optional, it’s essential. Key reasons include:

Chemical & Fire Hazards – The risk of explosion or toxic chemical exposure during production, storage, or transport

Defective Product Lawsuits – If a battery overheats or causes injury, manufacturers face liability even after third-party installation

Supply Chain Disruptions – Delays in acquiring lithium, cobalt, or rare earth metals can cripple production timelines

Employee Safety Regulations – California enforces strict OSHA compliance for hazardous material handling

Environmental Fines – Improper disposal of battery waste could lead to hefty state and federal penalties

Equipment Downtime – When production machinery fails, costs stack up quickly without equipment breakdown coverage

Frequently Asked Questions

Is battery manufacturing considered high risk by insurers?

Yes, due to fire hazards, chemical use, and environmental impact. But tailored coverage can reduce premiums and exposure.

Do I need product liability even if I outsource battery installation?

Absolutely. As the manufacturer, you’re still liable for performance and safety of the battery units post-distribution.

What’s included in pollution liability insurance?

It covers cleanup costs, third-party injury or property damage from chemical spills, and legal expenses related to contamination.

Is cyber insurance necessary in manufacturing?

Yes. Battery manufacturers use connected systems and store proprietary formulas and data, which are frequent targets of cyberattacks.

POLICIES

POLICIES

DISCOUNTS

DISCOUNTS

CLAIM

CLAIM

Still Have Questions?

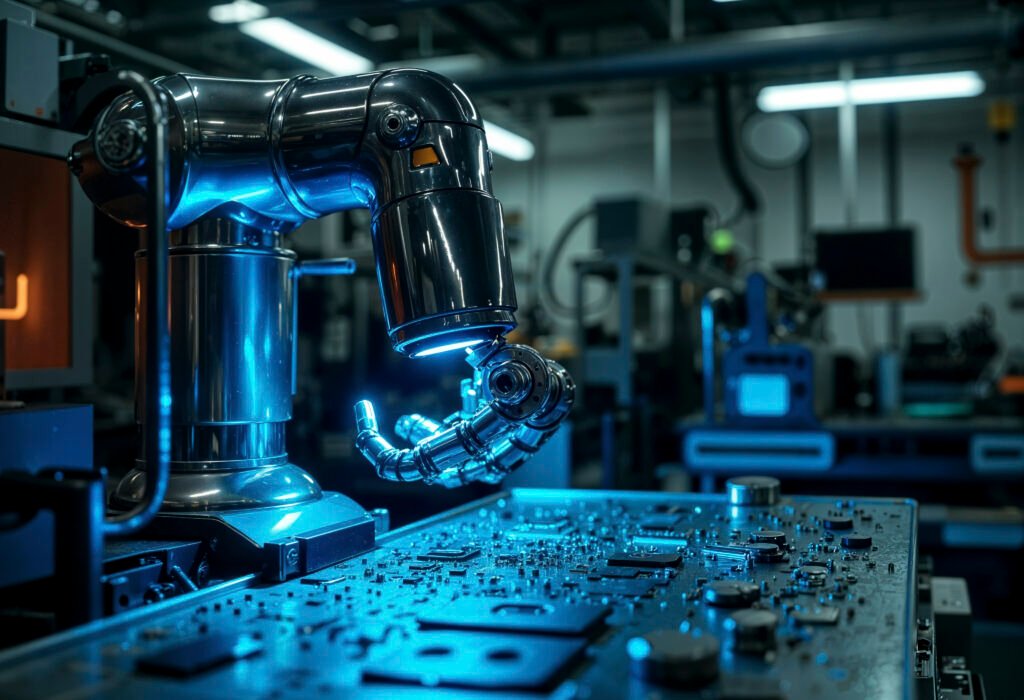

Whether you’re expanding your floor space or integrating new robotic automation, let’s make sure your insurance grows with your operation. Our team works closely with manufacturers across California to deliver scalable coverage that protects your shop now—and into the future.