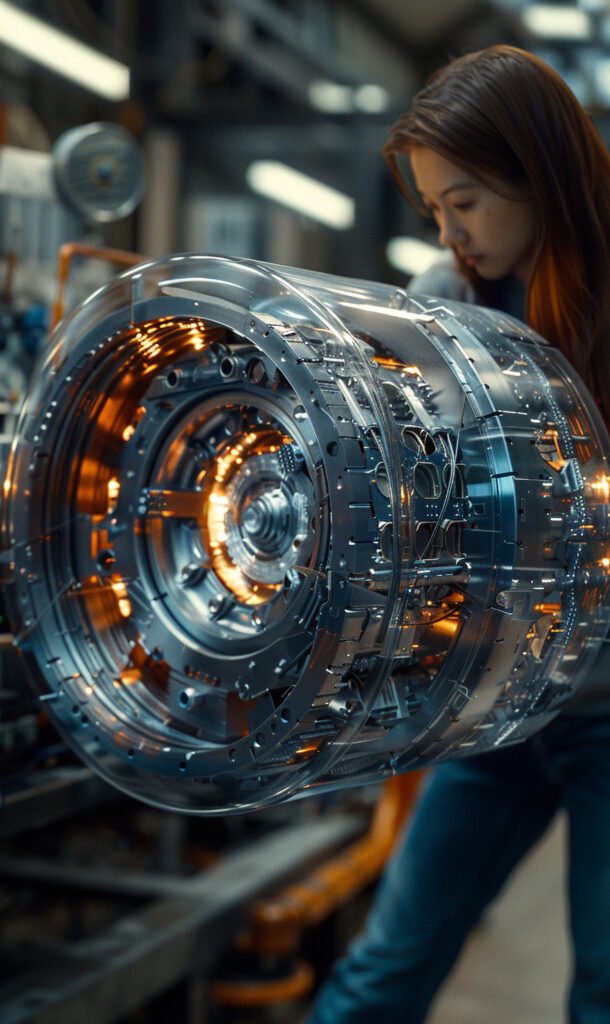

Precision at Altitude Comes with Risk on the Ground

Manufacturing aerospace components—whether for commercial, defence, or space industries—demands the highest level of precision, compliance, and accountability. A single flaw can lead to catastrophic consequences, both technically and legally. That’s why your business needs tailored protection.

Aerospace Parts Manufacturing Insurance offers custom-built coverage for your equipment, workforce, contracts, and long-term liabilities—ensuring you meet both FAA standards and client expectations.

Why Aerospace Manufacturers in California Need Coverage

California is home to major aerospace firms and subcontractors serving NASA, SpaceX, Boeing, and defence suppliers. But with high-profile projects come high liability:

FAA, ITAR & DoD Compliance – Insurance helps address gaps related to aerospace regulatory oversight

High-Cost Equipment – Multi-million-dollar tools require protection against breakdown or loss

Intellectual Property Risk – Proprietary designs and CAD files are targets for cyber theft

Supply Chain Liability – Defective parts can result in major downstream consequences and lawsuits

Employee Safety – Aerospace manufacturing involves lasers, high temperatures, and potentially hazardous materials

Contractual Insurance Requirements – Prime contractors and government agencies require specific policies in place

Pairing your policy with broader Manufacturer Insurance ensures full-spectrum protection for your operation.

Frequently Asked Questions

What makes aerospace insurance different from standard manufacturing coverage?

Aerospace parts insurance includes high-limit product liability, professional errors & omissions, and product recall—all essential for aviation-related products.

Is cyber insurance necessary for aerospace manufacturers?

Yes. Because aerospace firms handle proprietary technology, client data, and government contracts, cyber liability insurance is highly recommended.

What does product recall insurance cover?

It helps cover costs related to removing, shipping, and replacing defective components, as well as public relations and client notification.

How can I ensure my policy meets FAA or DoD contract requirements?

Work with an agent who understands aerospace standards. We customise insurance packages based on your regulatory environment.

POLICIES

POLICIES

DISCOUNTS

DISCOUNTS

CLAIM

CLAIM

Still Have Questions?

Whether you’re expanding your floor space or integrating new robotic automation, let’s make sure your insurance grows with your operation. Our team works closely with manufacturers across California to deliver scalable coverage that protects your shop now—and into the future.